Discovery tax certificate is a very important paper. It tells if a person or business owes any taxes. Many people need this certificate when they are selling a house, starting a business, or applying for a license.

This guide will explain what a discovery tax certificate is, why it matters, and how to apply. We will also answer common questions and give helpful tips.

What Is a Discovery Tax Certificate?

A discovery tax certificate is a paper from the tax office. It shows if you or your business owes any money in taxes. The word “discovery” means the tax office checks your records to find any taxes you may not have paid.

If everything is okay, you get a certificate that says you do not owe any taxes. If you do owe money, you must pay it before getting the certificate. From expert tips to trending updates, it’s all available on our main page sunnymoor .

Why Is a Discovery Tax Certificate Important?

A discovery tax certificate helps you in many ways.

1. It Follows the Law

Some states or cities ask for this paper before you can sell a house, get a business license, or take out a loan.

2. It Shows You Don’t Owe Money

It proves that you have paid all your taxes. This is good for people who want to buy your house or work with your business.

3. It Helps You Get Licenses

Some jobs or businesses need special licenses. You may need a discovery tax certificate to get one.

4. It Speeds Up Deals

If you have the certificate ready, your deals and paperwork will move faster.

When Do You Need a Discovery Tax Certificate?

There are many times when you need a discovery tax certificate:

- When you sell or buy a house

- When you open or sell a business

- When you apply for a business or work license

- When you want to borrow money from the bank

- When the tax office checks your records

How to Apply for a Discovery Tax Certificate

Getting a discovery tax certificate is not hard. Just follow these steps.

Step 1: Find the Right Office

Every city or state has a tax office. Go to their website or visit them to ask how to apply.

Step 2: Gather Your Papers

You will need:

- Your name and ID number

- Your business info (if you have one)

- Your house or property info

- Recent tax records

Step 3: Fill Out the Form

Most tax offices have a form you need to fill out. You can get it online or in person. Fill in every space carefully.

Step 4: Pay the Fee

Some offices charge a small fee. It may be $10 to $50. Pay by card, check, or online.

Step 5: Send in the Form

Send your form and papers to the tax office. Keep a copy in case you need it later.

Step 6: Wait for the Certificate

The office will look at your tax history. If you owe no money, they will send you a discovery tax certificate. If you owe money, you must pay it first.

How Long Is the Certificate Good For?

Most discovery tax certificates last for 30 to 90 days. Check the date on your certificate. If it expires, you may need to get a new one.

What If You Owe Taxes?

If the tax office finds you owe money:

- They will send you a letter

- You must pay what you owe

- After you pay, they may give you the certificate

If you don’t pay, you may get fines or liens on your house or business.

Mistakes to Avoid

Here are common mistakes people make when getting a discovery tax certificate:

- Giving the wrong info

- Forgetting to include tax papers

- Applying too late

- Not replying to emails or letters from the tax office

To avoid problems, apply early and double-check everything.

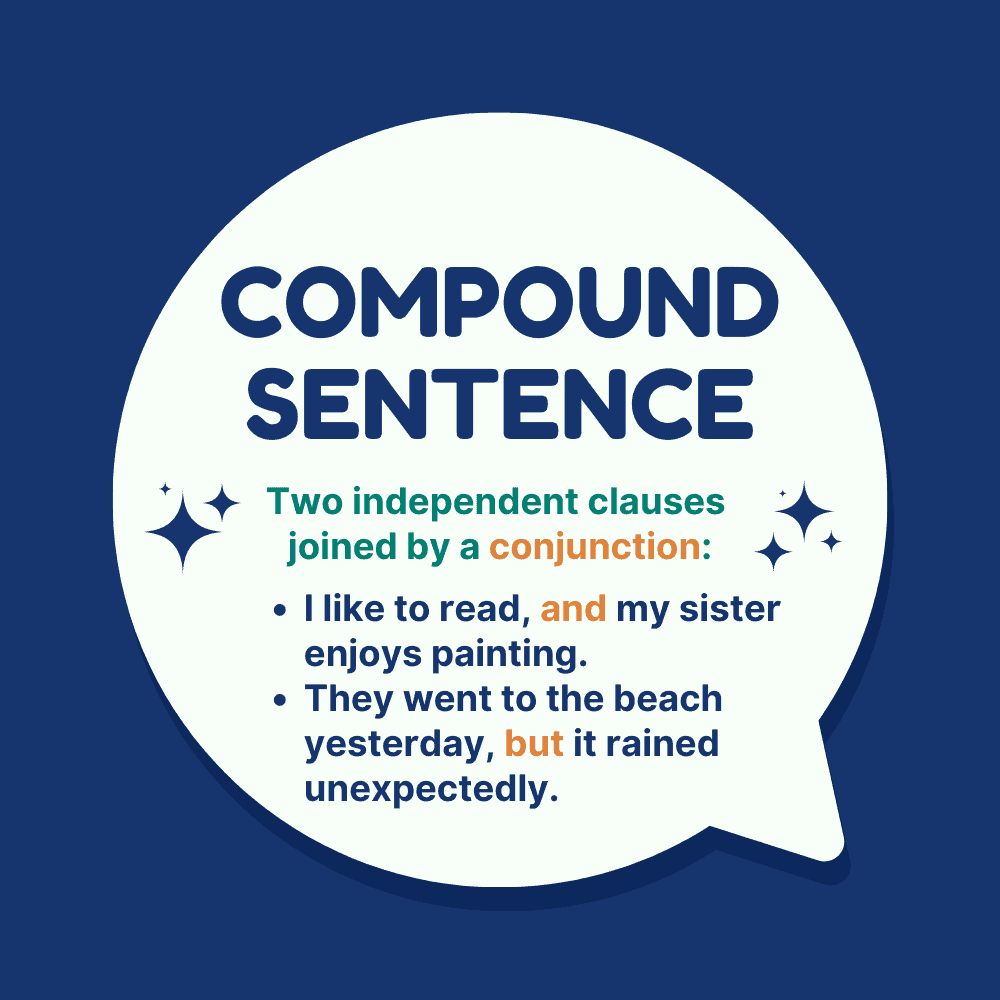

Discovery Tax Certificate vs Tax Clearance Certificate

Some people mix up these two papers.

- A discovery tax certificate checks your whole tax history

- A tax clearance certificate just shows you paid your recent taxes

The discovery tax certificate looks deeper and is safer for big deals like house sales or business transfers.

Can You Apply Online?

Yes, in many places, you can:

- Fill out the form online

- Upload your tax papers

- Pay the fee online

- Check your status

This makes it faster and easier to get your discovery tax certificate.

Why You Need It for Real Estate and Business

For buying or selling a house, the discovery tax certificate proves the seller has no unpaid taxes. Banks, buyers, and real estate agents often ask for it.

For businesses, it shows your taxes are in order. This helps you get contracts, licenses, and even loans.

Tips to Get Your Certificate Fast

- Keep tax records ready and up to date

- Apply early before any big deal

- Ask for help if you’re unsure

- Reply fast if the tax office contacts you

FAQ – Discovery Tax Certificate

1. What is a discovery tax certificate used for? It shows if a person or business owes any taxes. It is used for home sales, business deals, and license applications.

2. How long does it take to get one? It can take 5 to 20 days. Some offices are faster if you apply online.

3. What if I owe taxes? You must pay the taxes first. Then, you can get your discovery tax certificate.

Conclusion

A discovery tax certificate is a helpful and often required document. It tells others that you or your business do not owe taxes. You may need it when selling property, starting a business, or applying for permits.

Always apply early and follow the steps. If you owe taxes, fix the issue right away. This certificate protects you and helps your deals go smoothly.